Are you one of the 43 percent of adults using your smartphone for mobile banking? If not, you might be soon. By 2020, experts expect 81 percent of adults to be doing just that.

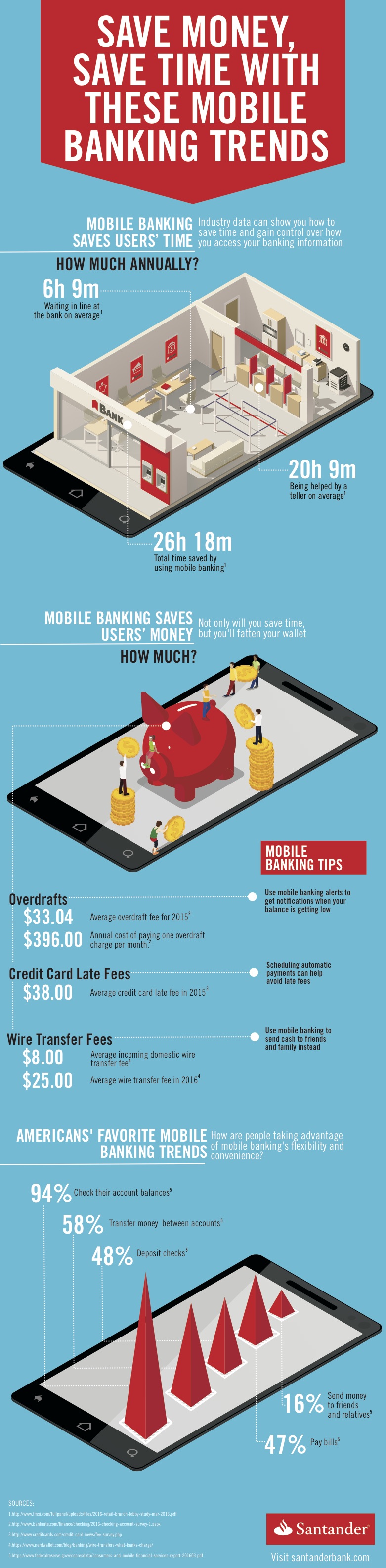

There are two big reasons this banking innovation has grown so popular: time and money. Mobile banking can help you streamline your financial life and advance your goals, such as building an emergency fund, paying down debt or saving a down payment for your first home. Other perks? Checking your balance on the go, conveniently sending money online and depositing your checks from anywhere with mobile check deposit.

Bottom line? Mobile banking can leave you with more time—and cash—to spare.